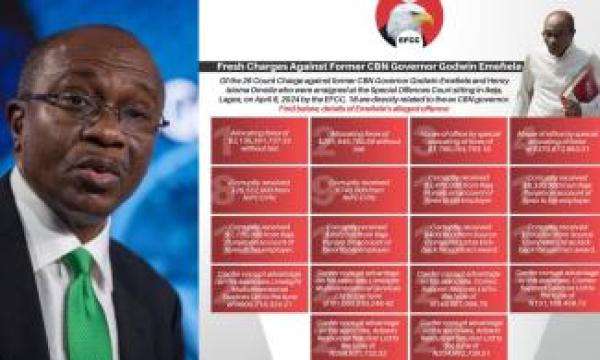

L-R: CBN Deputy Governor Operations, Kingsley Moghalu; the bank’s Deputy Governor Corporate Services, Suleiman Barau and the new CBN Governor, Godwin Emefiele, during the Governor’s maiden press conference on the new vision of the CBN on Thursday in Abuja.

The Governor of the Central Bank of Nigeria, Mr. Godwin Emefiele, on Thursday assured Nigerians that the apex bank would focus on gradual reduction of interest rates under his leadership.

Emefiele gave the assurance at a news conference to outline his policy focus as the new CBN Governor in Abuja.

The News Agency of Nigeria (NAN) reports that Emefiele who assumed office on Tuesday is the 11th CBN Governor.

He replaced Sanusi Lamido Sanusi, who was suspended by President Goodluck Jonathan before the expiration of his tenure.

“We shall pursue a gradual reduction in interest rates.

“A comparison of selected macro-economic aggregates from some emerging market countries, including South Africa, Brazil, India, China, Turkey and Malaysia indicate that Nigeria has one of the highest Treasury Bill rates.

“Such high rates creates preserved incentives for commercial banks to simply buy virtually risk-free government bonds rather than lend to real sector,’’ he said .

He said that to enhance financial access and reduce the cost of borrowing credit, there was the need to pursue policies targeted at making Nigeria’s Treasury Bill rate more comparative to other emerging markets.

Emefiele said that while reduction in both deposit rates would encourage investment attitude in savers, a reduction in lending rates would make credit cheaper for potential investors.

“The bank will also begin to include unemployment rates as one of the key variables considered for its monetary policy decisions.

“In the interim, we will continue to maintain a monetary policy stance, reflecting the liquidity conditions in the economy as well as the potential fiscal expansion in the run-up to the 2015 general elections,’’ he said.

On the exchange rate policy, he said the key goal would be to maintain exchange rate stability in view of the high import dependent nature of the economy and the significant exchange rate it passed through in recent years.

According to him, a systematic depreciation of the Naira would literarily translate to considerable inflationary pressure with attendant effect on macro-economic stability.

“Therefore, under my leadership, the bank will continue to focus on maintaining exchange rate stability and preserve the value of the domestic currency.

“We will sustain the managed float regime in the management of the exchange rate as this will allow the bank to intervene when necessary to offset pressure on the exchange rate.

“To support this strategy, we will strive to build-up and maintain a healthy external reserve position and ensure external balance,’’ Emefiele said.

(NATION)