The Nigerian capital market has shown hardiness as current stability in the nation’s currency, ongoing tight monetary stance and the reign of single-digit inflation are aiding real return on investments, helping to overshadow global and domestic policy concerns.

This is reflected on the Nigerian Stock Exchange (NSE) All Share Index (ASI), which increased 2.8 percent in October and is up 33.9 percent for the year despite US Fed’s stimulus taper concerns and the CBN’s tight monetary policy.

According to source, inflation has moderated to a five-year low of 8 percent in September, its ninth successive month in single digits.

The naira also gained in the official spot market by N1.08 (in October) on the back of the Central Bank of Nigeria’s (CBN) hike in cash reserve requirements (CRR) for banks, which drained liquidity from the system.

Market capitalisation stood at N12.02 trillion (November 8), while Nigerian stocks are now valued at 13x estimated earnings, higher than the MSCI frontier market index (a benchmark gauge for markets with an average capitalisation of $34 billion) which has a multiple of 12.55.

Foreign Portfolio Investor (FPI) transactions, which accounted for 36.9 percent of total transactions in January 2013, rose to 49.93 percent in September, according to the latest stock exchange data.

The real rate of returns for investors is eroded by a fall in the local currency and higher inflation, so the relative strength of the naira and benign inflation year to date are a positive for Nigerian capital markets.

The nation’s robust economic expansion which is providing a healthy backdrop for companies to grow earnings is also helping to attract investor interest.

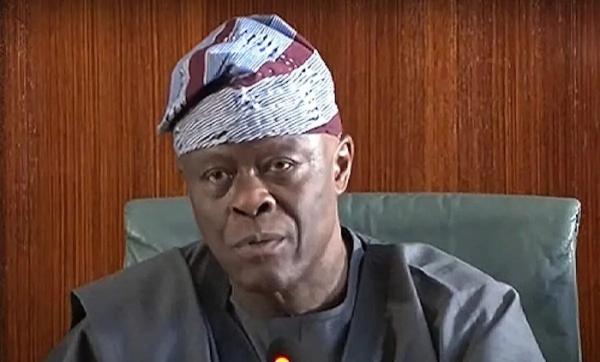

Source also said Bismarck Rewane, CEO, Financial Derivatives Company (FDC) Limited, in a presentation made on November 6, said: “The market is now striking a balance with transactions almost evenly distributed between domestic and foreign investors.”

Foreign investors are coming back to Nigeria’s capital markets after exiting in recent months on anticipation of Fed taper of stimulus and from negative sentiment due to the US debt limit stand-off. He added.