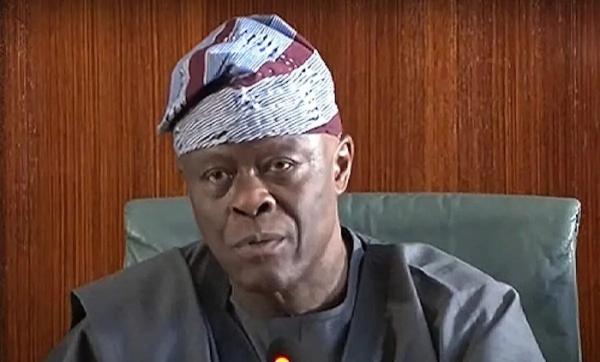

Dr. Ngozi Okonjo Iweala (Finance Minister for Nigeria)

CEOAFRICA news desk gathered that the country’s second Eurobond has been oversubscribed four times over the $1bn planned by the government to finance power projects across the country.

According to the Minister for Finance in Nigeria, Ngozi Okonjo Iweala, this development puts the economy of this country in stable condition the economy is stable and Nigeria is now the right place for investors to make profit. She also described this achievement as that which would complement Nigeria’s giant stride in developing its economy, as this would attract foreign investors across the world to the country.

While responding to questions, Samir Gadio, an emerging markets strategist at Standard Bank in London, said the sale of the five-and ten years bonds generated decent, albeit non-exceptional demand, as he acknowledged that the value of the valuation of the new Eurobonds look cheap.

“The price guideline for the ten-year implies a spread over United States Treasuries (UST) of 415 basis points (bps) while the outstanding 21s trade at 343 bps over UST at the moment,” Gadio said.

“Besides, emerging market Eurobonds has gained ground in recent days, suggesting that there is probably more yield compression potential in the secondary market in the immediate near term, especially if the typical bid from local financial institutions also materialises.”

Developing nations sold $35.5 billion of dollar debt in the first half, with yields as little as 2.72 percent, as investors searched for higher returns, according to data compiled by Bloomberg.

Furthermore, Gadio said, “The government will still have to pay a higher external funding cost than what it could have secured a couple of months ago and only shy of the initial levels of the Jan 2021 Eurobond (at the time a coupon of 6.75 percent and yield of 7 percent).”

Meanwhile, the Federal Reserve Chairman Ben S. Bernanke has said the Central Bank may reduce its $85 billion a month of bond purchases this year as a way of generating higher yields. This would help to salvage the emerging sovereign bonds that have lost their bid since May 22, 2013.

According to data released from the Debt Management Office (DMO), Nigeria’s total debt stands at 17 percent of Gross Domestic Product (GDP) as at March 2013. This comprises of $6.5 trillion in domestic debt (excluding AMCON bonds), and $6.67 billion in foreign dollar debt.

Nigeria was upgraded to BB-with a stable outlook, by Standard & Poor’s last year.

This development has helped to narrow the nation’s budget deficit to 1.85 percent of GDP in 2013, against the 4 percent recorded in 2009.